Corporate Growth Analysis on 7274781018, 692144045, 2130021380, 43000055, 8092201616, 1059423388

The corporate growth analysis of companies 7274781018, 692144045, 2130021380, 43000055, 8092201616, and 1059423388 reveals significant insights into their performance metrics. Key indicators such as revenue trends and market share provide a framework for understanding their competitive positioning. However, the analysis also uncovers underlying challenges and necessary strategic adjustments. Examining these factors may offer critical implications for future investments and long-term sustainability within an evolving market landscape.

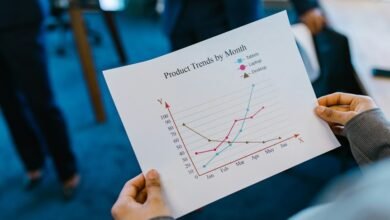

Overview of Growth Metrics for Each Company

As companies navigate the complexities of market dynamics, a comprehensive overview of growth metrics becomes essential for evaluating their performance.

Analyzing growth rates reveals insights into sustainability, while revenue trends indicate financial health.

Monitoring market share provides context for competitive positioning, and conducting a profitability analysis ensures that growth translates to increased margins.

Together, these metrics form a strategic framework for informed decision-making.

Key Drivers Behind Corporate Success

While various factors contribute to corporate success, a few key drivers consistently emerge as pivotal in shaping a company’s trajectory.

Innovation strategies fuel growth, while market expansion enhances reach.

Leadership effectiveness cultivates a strong vision and aligns teams, fostering a competitive advantage.

Furthermore, robust customer engagement and operational efficiency streamline processes, ultimately positioning companies for sustained success in dynamic markets.

Challenges Faced by the Companies

Navigating the complexities of today’s business environment presents numerous challenges for companies striving for growth and sustainability.

Market competition intensifies the need for operational efficiency and financial stability. Additionally, regulatory hurdles complicate compliance efforts, while talent acquisition becomes critical amid an evolving workforce landscape.

Companies must also adapt to technological advancements, balancing innovation with risk management to maintain a competitive edge.

Future Outlook and Investment Implications

Although the business landscape is fraught with uncertainties, the future outlook for corporate growth remains promising, driven by strategic investments in innovation and sustainability.

Companies poised to adapt to emerging market trends will likely thrive. Therefore, investment strategies focusing on technology and eco-friendly practices are essential for capitalizing on growth opportunities, ensuring resilience against market fluctuations and enhancing long-term profitability.

Conclusion

In the intricate tapestry of corporate growth, the six companies resemble diverse trees in a competitive forest. Each tree thrives through unique roots of innovation and efficiency, yet faces the stormy winds of market competition and regulatory challenges. As they seek sunlight through strategic investments, their ability to adapt will determine whether they flourish or wither. Ultimately, the future beckons with opportunities akin to a fertile soil, but only those who navigate wisely will reap the rewards of sustained prosperity.